As soon as markets start to go up and stay up for a few months in a row, someone starts predicting that they will crash. And when the TSX and NYSE hit new “record highs” the buzz became almost deafening: Now a MAJOR market meltdown was inevitable–it was just a matter of when. But why? Why do people assume that markets reaching all time highs mean a crash is coming: if the stock market is supposed to return an 8% or higher average, doesn’t it mean it MUST set new records and fairly steadily?

Why Does Anyone Invest in the Stock Market?

Investing for Income

Some people invest in companies listed on the stock markets to get dividends and distributions. Their investment choices are driven by a need for income.

Not all companies offer dividends or distributions though. Why would people buy shares in those companies?

Investing for Capital Gains

Many other people are investing in companies’ stocks to try to win a capital gain. They want to pay $20 for a share and sell it to someone else for $40, or more. They are willing to buy shares that don’t pay anything to investors but which may be worth more in the future than they are now.

Obviously, sometimes these investors are unlucky. The perceived value of the company drops and if they sell their shares they realize a capital loss.

Shouldn’t the Stock Markets Indices, Over Time, Go Up?

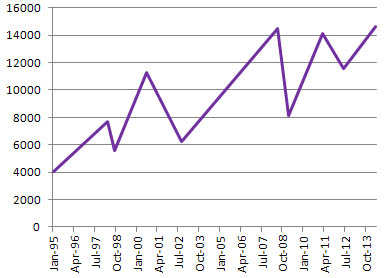

If you go to a site like Yahoo Canada finance, or sign in to a brokerage website, you should be able to look at a graph of the S&P TSX Composite Index over several years. Go to https://ca.finance.yahoo.com/q/bc?s=^GSPTSE&t=my&l=on&z=l&q=l&c= and if necessary click on: Max

It should have jagged peaks up and sharp valleys down, but there should still be an overall trend in an upwards direction. Or at least there should be if you believe that investing in the stock market should yield you a capital gain, over time, if you invest a tiny bit in every company in that market index.

If you look at the last 10 years of the S&P TSX Composite, you will likely notice it spiked up to a nice point at about 14 000 in 2011 and it’s currently (in September 2014) at 15 000 and still climbing. In 2008 it also reached over 15 000. On January 1, 1985 it was under 3 000.

The overall trend from 1985 till now is up.

So why, just because we are finally trading in the 15 000 plus range, are people shouting it’s going to crash?

For people who had all of their money invested before May 2008, and who invested for capital gains not for dividends or distributions, it must seem like the party is just about to start. For years they’ve waited patiently, pocketing any useful distributions and dividends, but biding their time waiting for some big ticket capital gains.

Unless there’s some “invisible ceiling” at just over 15 000 why should anyone be panicking?

Doesn’t Couch Potato Index Investing preach that you don’t try to time the market, you just buy steadily and hang on for the ride? I’ve never read an index investing article that said there is a maximum the market is allowed to rise.

Why I Am Still Investing a Bit a Month Every Month Into the Index Funds Mirroring the Stock Markets

I’m not the usual type of investor. I’m very conservative and very risk averse. So my portfolio stands on a wide, thick platform of fixed income securities. Enough, in fact, to provide a modest retirement income if all of our other investments failed.

Most of our new money, however, is going into the equity markets.

While we are deciding, we are putting some of our new investment funds into both. It’s wishy washy but it beats having everything sitting in cash.

So every month, we put a bit more into the stock market in the form of “buy the entire market” “ultra low fee” ETFs.

And I don’t see any reason to stop doing that just because the markets are at “all time highs.” If they never pass today’s “all time high” then there is no actual capital gain ever to be made by investing in index funds. A whole branch of the investing industry is mistaken. They will all lose money and never be able to speak on CTV or CBC again.

That seems unlikely to me. Yes, there may be a market pullback or even a radical plummet. But if you believe that capital gains can be made by investing in an index-matching-style then sooner or later, the money you invested in an index should return to parity and should, ultimately, increase in value.

I don’t like the uncertainty. I don’t like wondering if I might be buying just at the time when the rug is about to be pulled and the market will tumble into a trench it will take years to climb back out of. But that’s the uncertainty I have to accept if I want to invest in index-linked products in order to (theoretically) capture some capital gains worth more per dollar invested than my fixed income investments can yield.

Wish me luck!

Related Reading

Join In

Do you index or couch potato invest? Do you have faith that the S&P TSX Composite must eventually keep rising about 15 000 and in fact above 16, 17, 18, 19 and even 20 000? Or are you selling out, buying food and ammo, and building a bunker out of gold bricks? Please share your views with a comment.