Why Couch Potato Investing Doesn’t Work …

… For Everyone

Sorry but I couldn’t resist a trick title like that: It’s Friday; It’s overcast; It’s been raining and cold all week so few warblers are bothering to move: I’ve got to have something to smile about. However, today I will argue that for some people Couch Potato investing, also known as index investing, does not work.

What Do I Mean by Couch Potato or Index Investing?

There are several different investing methods that get lumped together under the heading index investing or Couch Potato investing. There is an absolutely fantastic website about this type of investing run by the Canadian Couch Potato at http://canadiancouchpotato.com/ for those of you who would like more information.

What I’m discussing here is a “basic” Couch Potato method of investing:

You invest in 4 types of ultra-low-cost ETFs:

- A Canadian equity fund that matches an extremely broad and diversified Canadian index

- A US equity fund that matches an extremely broad and diversified US index

- A Foreign (non-US, non-Canadian) equity fund that tries to capture a broad swath of the businesses listed on the various international stock exchanges

- A bond fund (often one with a short term-to-maturity and a mixture of government and corporate high quality bonds)

The percentage invested in each of the 4 ETFs could vary but a common split would be 20% Canadian; 20% American; 20% Foreign; 40% Bonds.

You split your money and invest it at the correct percentage in the 4 different ETFs.

Monthly, quarterly or semi-annually you add new contributions proportionately.

Once a year, you re-balance the portfolio to keep your asset allocations at 20/20/20/40. This could be done by buying more of the class that has dropped with your new contribution or by selling some of your excess units and buying more of your missing units. (E.g. if your allocation has become 30/10/20/40, you would sell some of the 30% ETF and buy more of the 10% ETF.)

You keep doing this for 10-50 years.

You do NOT sell your ETFs randomly just because the stock market is going up or down, only annually if you need to re-balance.

You do NOT invest extra in one of the 4 ETFs just because “it’s on a roll” and you want to make some extra money quickly.

Why Does Couch Potato Investing Work?

This type of index investing works because it takes all of the guess work, timing and emotion out of investing.

It’s based on the theory that over time the value of money invested in the stock markets and bonds will increase so if you invest in them and stay invested at all times, the value of your investments will increase.

Some will argue that you will even earn the most by investing in this way. That gets way too complicated for me to be interested in, but it is generally agreed by everyone that it is a very good way to invest which should result in an increased value of your savings over time.

I keep saying “over time” because at any one MOMENT in time, the value of your investments may NOT be higher. And that’s the problem.

Couch Potato Index Investing Does Not Work for Everyone

The reason couch potato index investing does not work for everyone is that not everyone can stick to it.

Some people cannot accept seeing large decreases in the value of their investments.

Other people cannot accept seeing investments not increase in value over several months or even years.

For example, following a simple Couch Potato portfolio, an investor might put 20% of their money into an International equity ETF. Let’s say they invested $10,000.

During a nasty period of market upheaval, they may see the value reported for their investment in that ETF drop to $7000.

To be a proper Couch Potato investor they must

- Shrug and ignore it, until

- during their yearly asset allocation re-balancing time

- when they must either sell some of their other ETFs to bring the percentage back up to 20% of their portfolio, or

invest new money in this ETF until it comes back up to 20% of their portfolio.

That’s right: They have to sell their “winner” and buy more of their “loser”; or put more new money into their “loser.”

Because it’s not really a “loser.” It’s just an ETF that has dropped in value. Over time, lots of time, the Couch Potato philosophy says that it will go back up in value and in fact increase in value over the starting value. So by re-balancing, the investor is actually buying more of a “bargain” ETF not a “loser” ETF. And doesn’t everyone like to buy a bargain?

Some people, though, just cannot handle this. At best they will ignore this drop in value of the international ETF and refuse to rebalance their asset allocation annually. At worst they will sell out of their entire position in this international ETF “dog” and put the money into something else.

Either way, they are no longer investing in the Couch Potato Index style.

They are not likely to succeed as a Couch Potato investor because they are ignoring the simple, basic rules that make this style work.

How Can I Decide If I Can Succeed as a Couch Potato Index Investor?

It’s really not possible to be sure how you will react to a dizzying drop in the value of an ETF until it happens. However, you can ask yourself some tough questions to get a glimpse of how you might feel.

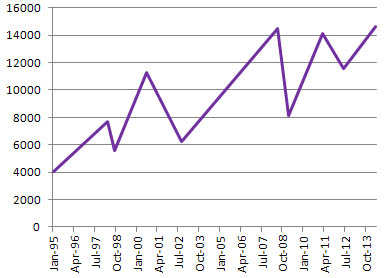

The internet is full of great charts.

https://ca.finance.yahoo.com/echarts?s=^GSPTSE

is a link to a Yahoo chart of the value of the S&P TSX Composite Canadian index. If you click on the Max link under the chart, you will see how it has behaved for many years.

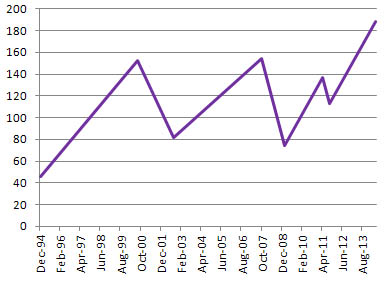

https://ca.finance.yahoo.com/echarts?s=SPY#symbol=SPY;range=my

is a link to a Yahoo chart of the value of the SPDR S&P 500 NYSE. If you click on the Max link under the chart, you will see how it has behaved for many years.

It’s not just important to look at those sharp drops.

It’s also important to look at the width between two points at the same height. The width is how many months or years it took for the index to return to the SAME value. Not to increase, just to return to where it was.

Looking at the Yahoo TSX chart, if you bought units in a matching index fund only in August 2000, you’d have had to patiently wait until about December 2005 just to *break even*. (Dividends will help a bit but not as much as you might think if you buy a “most of the TSX” ETF. Many TSX stocks pay almost nothing in dividends.)

Similarly, if you bought in only at June 2008, you’d have to wait till February 2011 to break even and even then it would go down again only rebounding by September 2013.

If you bought in only during April 2011, you would only have broken even in October 2013.

The SPDR S&P 500 chart also shows the need for patience. Someone who bought only in September 2007 had to wait till early 2013 just to break even.

NOTE: These charts are not meant to represent the actual ETFs you might buy in your portfolio. They are just meant as quick examples of real market fluctuations.

Are You Brave, Patient and Stalwart Enough to be a Couch Potato?

Intestinal fortitude. That’s what you need to be a good Couch Potato index investor.

You have to be prepared to stomach more than a 30% market drop for one, or more, of your ETFs.

If you truly want to be a Couch Potato, you have to be prepared to lounge back through a 50% market drop and keep waiting, often for years, for your holdings to gradually climb back up to where you bought them at.

That means you have to wait to *break even*, not just to make a profit.

If you sell during a drop, you will almost always lose. And you are not a Couch Potato Index investor any more.

Some people who try to be Couch Potatoes panic when the markets drop. They sell low. They won’t wait years for a rebound. They then curse the markets and stalk off to invest only in GICs and savings accounts.

Regular contributions do make drops easier to weather because you buy some new units when prices are low to help offset the ones you bought when prices were high. It makes it feel like you’re making money more quickly as you wait for the re-bound.

Proper annual rebalancing is also critical and as a bonus it can obscure the cause of your paper losses. (Remember they are not TRUE losses unless and until you sell your ETFs.)

Who Does Couch Potato Index Investing Work For?

It could work for anyone, if they let it.

It certainly will work for someone who is totally dispassionate about finances and fully capable of ignoring even catastrophic market crashes because he/she understands and believes the mathematics behind this investment method.

It works for thousands of people.

It might work for you.

Am I a Couch Potato Index Investor?

No.

I won’t let it work for me: I am extremely risk averse. I know I would not be willing to watch 20% of my invested money (in any one index) drop to half its previous value.

We do use Couch Potato Index Investing within one of our defined contribution pension plans. Frankly we have no other logical choice. It’s doing reasonably well but it sure does hurt to wait out the times the markets are down and the agonizingly long time it takes for the markets to rebound. Fortunately, our bonds fund did extremely well during the last market drop which buffered the loss somewhat.

Related Reading

- How to Buy Stocks and ETFs at BMO InvestorLine

- How to Buy Stocks and ETFs at RBC Direct Investing

- How to Buy Stocks and ETFs at CIBC Investor’s Edge

Join In

Are you a Couch Potato Index investor? Or do you actively trade? Or are you a Fixed Income Only investor? Or do you take a hybrid approach? You’re probably doing reasonably well using any method if you have no debts and are steadily saving money. Please share your opinions and advice with a comment.

Your examples of how long it took to break even on stock index purchases ignore dividends. Dividends are an important part of stock returns.

It’s true that indexing doesn’t work for everyone in the same sense that eating right and exercising doesn’t work for everyone — because many people don’t do it for one reason or another. However, jumpy investors can’t do well with any investment strategy that involves higher risk and higher reward unless they find a way to tame their urge to sell low.

Actually I did mention dividends although I admit it’s a long post and easy to miss. : )

Here’s an example, of why the dividends, though helpful, are not particularly great for an ETF that is trying to cover a broad diverse market, for the SPDR 500

fund the dividend yield is currently 1.85%. https://www.spdrs.com/product/fund.seam?ticker=spy

While every bit helps, it will still take a long time for that ETF to recover even with this dividend from a drop of 30% in value until the market itself climbs.

(I just selected this ETF at random for an example. I’m sure there are others which are much better.)

It’s harder for me to be sure but it looks like the Vanguard S&P 500 has a dividend yield of between 2% and 3.4%. (The 3.4% high value is if I add the 4 most recent distributions and divide by the ETF’s lowest value for the past 52 weeks.) Again useful but not enough to offset a large market drop quickly. https://personal.vanguard.com/us/funds/snapshot?FundId=0968&FundIntExt=INT#tab=1

Still, I do believe in dividends. They kept me from selling BNS when it was sounding for the deeps last year!

“The SPDR S&P 500 chart also shows the need for patience. Someone who bought only in September 2007 had to wait till early 2013 just to break even.”

The above statement is not true. The breakeven point came earlier. You can find this point using the “Adj Close” column of Yahoo historical prices. Simply mentioning dividends doesn’t make the statement true. From the beginning of September 2007 to the beginning of February 2013, SPDRs were up 11%, even though if we ignore dividends SPDRs were down 1%. The longer the period of time, the bigger the difference dividends make.

The break even I used was not from Yahoo, it was from an ETF that mirrored the SPDR. I traced along the NAV until the originating point was reached again. It didn’t state it included any dividends so presumably it didn’t. From the information the ETF provided, it also didn’t include any indexing to inflation. There was nothing on the chart to say that the NAV had been adjusted to use all values as present day dollars. I doubt they were. The approximately 2% dividends would offset the inflation and leave the investor a bit ahead.

My point, and I stand by it, is that many investors tire of waiting just to get back to where they started and they sell. Couch Potato and indexing work very well for dispassionate investors but not so well for those who invest with their feelings not with their brains.

I just signed up for my pension plan at work, and I had the option of going with automatically re-balanced funds (SunLife Granite Funds if your familiar – they have target dates), do it yourself. The do-it-yourself has a few options that would turn into Couch Potato investing, but I opted for the other ones. Mostly because I am not sure I could manage the act of re-balancing and watching things tank. Perhaps when I am more investing savvy, but it just might not be for me.

Interesting that you have both options through your pension plan. Did you take a hard look at the fees? Sometimes they can make choosing one or the other more simple: some target funds have very high fees (although if the employer is large enough they can be quite reasonable.)

Since you’re just starting a pension there, you could even let it ride for a year or so and take a more detailed look when you have some real numbers and an annual report to evaluate.

Frankly I think DC pension plans are a time bomb. Most Canadians are not financial experts nor do they want to become one. Expecting them to make difficult decisions like the one you’ve just made is wrong.

Congratulations on getting to join a plan though! It puts you ahead of the 60% of Canadians who have no work-related pension. (CBC News: “About two-thirds of working Canadians don’t have a company pension…”http://www.cbc.ca/news/business/canada-post-opg-highlight-public-pensions-problem-1.2459995)

The fees for the target funds are all 0.77% or lower. The ability to do it yourself does have lower fees by about 0.1 – 0.2%, but I’m not comfortable enough yet to go that route. Maybe one day. And that’s basically my attitude – to just get my investing feet wet while earning my employer match.

Our plan is intriguing in that it basically has loads of flexibility, and we can have a hybrid RRSP and pension. So my mandatory contribution can go either in the RRSP or the pension (I chose RRSP), and the employers must go in the pension.

I’m just happy to have the opportunity to have decent retirement savings. I’m still relatively young, so it’s now just a consistent savings game because I have time on my side.

It’s good that the fees are so close on the two options. After a year or so you can see the details from your transaction history and make sure it all is working the way it should.

Having a company pension plan is a great benefit!

I’m too hands on and too much of a control freak to think it would work for me. I have an ego I need to keep intact as an engineer who likes numbers, so I trade/invest in stocks.

I say trade/invest because depending on how they are doing to what I thought they should do, will determine if I trade it on what I think are highs and lows, or hold it, because it is doing just what I thought it would.

Has this worked for me? yes and know.

Do I feel I’m doing an okay job at it, yep.

Am I comfortable with what I am doing and can sleep at night, again yep. For me it is all about control.

Now that said, I do have some rules for myself that I set for each stock I hold, which can take a good portion of the emotion out of it. But some of my biggest gains have come as a result of my emotions, so I cannot give that up.

For the most part too, we have little to no debts (less than 4% of assets involve debt), which does eliminate a fair bit of the stress from when we had debts and trying to do the same. For the record, we were down 40% in 2008 crash, but were debt free at the time, so I timed some debt and rode up the return to normalcy all the while paying down the debt as the stocks rebounded. So in short, nope, not a couch potato investor, I am an hybrid active trader/investor.

As to my fixed income side, I consider our home and recreational property as our “bond”/fixed income, as they are both owned debt free… We are all cut from different cloths, but essentially all made up of the same threads. My recommendation to all those starting out, figure out what type of investor you are early in life. – Cheers.

Sounds like a good, if not easy, strategy. As you say there are many intertwined paths to the same destination.

My finances are still a mixed up mess, but I’m picking through them and straightening them out a bit at a time. We won’t ever make the “highest” return–I’m too risk-averse for that–but we have never had any debts and we’ve paid off our home and have maxed out RRSPs, TFSAs, and (the grant-matched-part-only) RESPs. so we’re not too worried about that. Our needs are pretty simple. We just need to continue to save and perhaps grow our assets a bit more and we’re on a path that should get us there.

Hi,

Helpful article.

I’m not smart enough to do all the math and factor in all the variables, all of which are unknown to me, but in your assumptions did you consider that low management fees of 0.2% or less could off set the drop in the market?

Does this have any affect on the performance of a couch potato portfolio?

For example, if a guy is saving on management fees, say $2,200 per year on a $100,000 portfolio, would the low periods in the market be offset by the savings he made on MERs?

Thanks for explaining.

The best source of info on potato investing is at http://canadiancouchpotato.com/

Yes, the lower the fees you are paying, the better off your portfolio will be whether the markets are in retreat or booming.

Will saving 2% offset a market drop of $13%? Not immediately but it will certainly take less time to recover than from a drop of 15% which is what someone paying 2% more would be experiencing.

I think couch potato investing works very very well for anyone who can stick to the strategy and not sell or stop investing or stop re-balancing when the markets are declining. If you are one of those people, stick with your plan and you should be fine!